2024 State of

Video Technology

The Video Gap Continues

Consumers want video from brands,

but they’re not getting it.

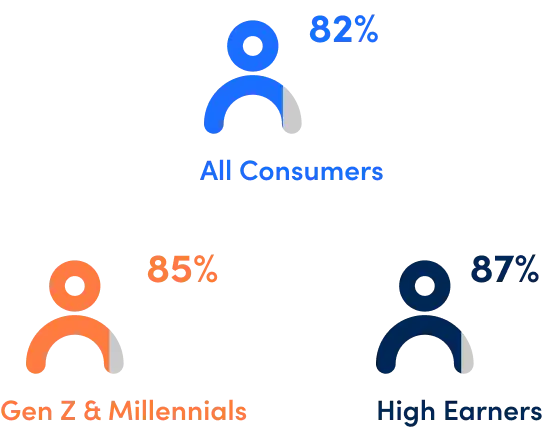

Over 8 out of 10 (83%) of people want more video content from brands, but only 19% say they frequently receive it. While that’s a slight improvement from last year, when 18% of consumers regularly received video content from brands, there’s still a long way to go, especially considering that the demand for video has only grown year over year (up from 81% in 2023).

What’s alarming is that the majority (64%) of consumers rarely or never get video from brands. That’s down from 70% of consumers in 2023 and 74% in 2022. Still, with so many consumers saying they want more video content, the message to brands is clear — increase the use of video in your digital communications strategy.

It’s worth noting that this market study covers brand communications between businesses and their customers. Survey questions didn’t focus on video as an advertising tool but rather as a means of communication from a business such as a bank, healthcare provider, insurer or phone carrier. Findings show that video isn’t used to its full potential in customer communications.

Want More Video From Brands

Frequently Get Video From Brands

When people are lucky enough to get

brand videos, they like it.

This video gap represents a big opportunity for brands who want to be more customer-centric. Customers are eager and relatively easy to please.

Next Generation Video in Demand

Personalizing videos drives customer loyalty.

Personalized Video Compared to Generic Video

a customer feel valued

by a brand

a customer trust

a brand

someone become or

remain a customer

customer recommend

a brand

Personalized video is 4x more likely than generic video to make customers feel valued, but most people never receive one. That makes it a powerful differentiator for brands.

Consumers are willing to exchange

data for personalization.

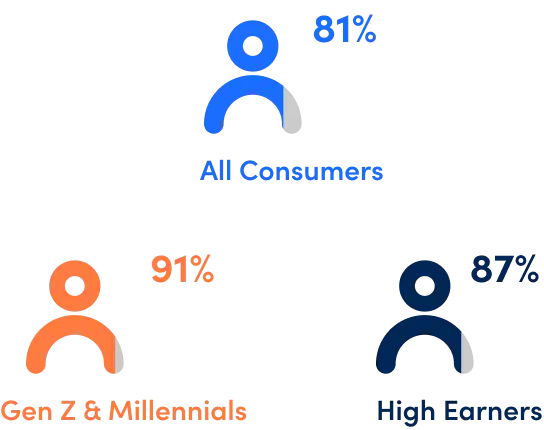

Nearly three quarters of all consumers (73%) will share their data if it means they’ll get a more personalized experience. This is especially true for Gen Z, where 81% will share data to enable personalization.

Despite reports of data breaches and cybersecurity threats, customers largely trust brands with their data. That trust has increased year over year with 74% in 2024 saying they trust businesses to keep their data secure vs. 68% in 2023.

There’s also more interest in personalization in general. This year, over 7 out of 10 consumers (73%) would like to see communications from brands be more personalized in the future.

Willing To Share Data for Personalization

Viewers are more interested in

interactive video than ever.

Consumers reward video innovation.

When a business uses advanced video technology to communicate with customers, it makes an impact on how people view the business. This includes their interest in engaging with brand content and even how likely they are to buy the brand’s products or services.

Consumers are over

Consumers are nearly

to buy from a brand that

uses advanced video

tech.

to see a brand as

innovative when it uses

advanced video tech.

Gen Z and High Earners

Younger and more affluent consumers still lead the video innovation demand curve.

In our surveys from 2022 and 2023, the data showed that younger consumers, especially Gen Z, and higher income earners share similar preferences when it comes to digital communications. This includes interest in all kinds of video technology.

a personalized video than a

non-personalized video.

Interested in Interactive Videos From Brands

Gen Z

High Earners

Interested in AI Videos From Brands

Gen Z

High Earners

An overwhelming majority of Gen Z — 93% — is interested in receiving interactive videos from brands, and 91% are interested in videos they can customize.

These high-value demographics also care the

most about video and personalization.

While everyone likes video content, these two cohorts appreciate it the most. They’re also more comfortable exchanging their data for a more personalized experience.

high earners (89%)

want more video

from brands.

high earners (79%)

will exchange data

for personalization.

Both groups are keen to get hands-on with

AI video.

In 2022, we saw that both of these consumer segments are early adopters. They were the first to express significant interest in interactive and user-customizable video. Now, they’re the ones most likely to be interested in creating AI text-to-video content.

High earners and Gen Zers were also more likely to say access to an AI tool that lets them create videos from text would positively impact their video production. While 75% of consumers say such a tool would make them more likely to start or increase their video content creation, 82% of high earners and 89% of Gen Z say the same.

Of those who were interested in creating AI videos, overall quality was the most important factor. This was consistent across generations and income levels.

Interested in an AI Tool That Creates Videos From Text

AI Video on the Rise

Consumers are ready for this

latest wave of video innovation.

Consumer interest in AI-generated video from brands isn’t as high as their appetite for video content that’s personalized, interactive or even user-customizable. But a majority of adults (65%) say they’re open to this kind of content from businesses.

Consumers Ready for AI Video

are interested in receiving AI

video content from brands.

But they also have some reservations

about the use of AI.

Nearly 6 out of 10 consumers (59%) say they have concerns about artificial intelligence, ranging from the lack of personalization to the risk of inaccurate content. But 72% of those who do have concerns believe that they can be addressed.

Concerned About AI

Believe Their Concerns Can Be Addressed

Viewers prefer video generated by AI

to text-based communication.

Across generations and income levels, consumers embrace AI video when it makes content easier to understand. When shown a document and a video made from that document using AI, consumers were twice as likely to choose the video.

This doc (or website) to video use case was also the one most preferred by respondents who said they might be interested in creating an AI video. This is interesting given that it edges out the more commonly known text to video use case.

The preference for doc to video AI is even higher among those who identified as self-employed, suggesting that business owners may be more interested in using AI to create content from assets they already have on hand, such as presentations, PDFs, their knowledge base, etc.

generated from a document

than the document itself.

U.S. consumers are more interested in AI-

generated video than their U.K. counterparts.

While 72% of Americans reported being interested in or open to receiving AI video from brands, only 58% of U.K. respondents said the same. But Americans are also more concerned about AI in general than those in the U.K. Only 54% of respondents in the U.K. said they had concerns about AI compared to 63% in the U.S.

Of note, Americans were also much more likely to say their concerns about AI (if they had any) could be addressed. While 8 out of 10 Americans said this, only 64% in the U.K. agreed. The top reason cited for both demographics was a lack of trust or concerns relating to AI in general.

With personalized video a strong driver for trust, it could be a practical tool to pair with AI-generated content to help increase consumer confidence in this kind of video communications.

Interested in AI Video From Brands

Concerned About AI Video

Sharing This Report

You are welcome to share data from this market study on your website as long as you provide a link to Idomoo in a prominent place alongside the statistics and findings shared.

Methodology

Idomoo and Atomik Research conducted a study of 2,008 consumers in the U.S. and the U.K. in January 2024. The margin of error is +/-2 percentage points with a confidence level of 95%.

Defining High Earners

For this study, higher earners in the U.S. were considered those with an annual income over $150,000. In the U.K., high earners were those with an annual income over £75,000.