Market Study 2023

For the latest consumer trends, view this year’s report. But if you want to see historical data, you can also download our 2023 market study.

The Video Gap

Consumers want video from brands,

but they’re not getting it.

Over 8 out of 10 (81%) of people want more video content from brands, but 70% of consumers say they rarely or never receive video from brands. That’s down from 74% last year, meaning brands are using video more for digital communications — but not nearly enough.

Consumers who want more video from brands

Consumers who rarely or never receive video from brands

Personalised Video:

A Loyalty Driver

Most consumers want video to be personalised to them.

Though most consumers haven’t ever received a personalised video, there’s an increase in both interest and market awareness from last year. Market penetration is higher in the U.S. than the U.K.

in personalised video

than not

Have you received a personalised video from a brand?

Personalised video consistently outperforms generic video.

Validating our 2022 findings, video that’s personalised outperforms video that isn’t personalised by a factor of 3x or more. All of these numbers were about the same as last year or slightly higher.

Personalised Video Compared to Generic Video

customer feel valued

by a brand

customer recommend

the brand

to increase loyalty

and brand trust

Quality makes a difference.

How do people want their video to look? We showed consumers two kinds of personalised videos with the same use case. The one with higher production value, in this case, live action vs. animation, scored better for making the consumer feel more valued and making them more likely to remain a customer.

the style of higher quality personalised video

The Video Innovation Consumer Hack

High-value consumer segments already want the next wave of video technology.

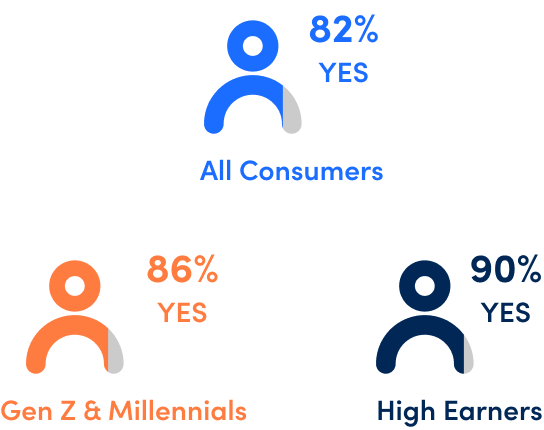

In 2022, we found that younger consumers and high earners had the highest interest in advanced video technology. This year, we again asked consumers about innovative video tech like interactivity and user customisation, where the viewer can update their video directly from the player.

Interested in Interactive

Video From Brands

Interested in Customisable

Video From Brands

Interest in AI video spikes highest among these early adopters.

Younger and more affluent consumers, identified as early adopters of advanced video functionalities, were particularly interested in AI-generated video, indicating this may be the next trend in video innovation.

Gen Z & Millennials

High-Income Earners

in AI-generated video

in AI-generated video

Compared to other generations

Compared to other income brackets

Innovative video tech influences consumer behavior.

The data shows that younger consumers and high earners were the most likely to engage with the brand based on their use of innovative video tech.

Gen Z & Millennials

High-Income Earners

with a brand’s content

if they use innovative

video tech

a brand if they use

innovative video tech

with a brand’s content

if they use innovative

video tech

a brand if they use

innovative video tech

Compared to other generations

Compared to other income brackets

The U.S. is showing higher interest in innovative

video tech than the U.K.

Americans are 10%-19% more likely than their U.K. counterparts to be interested in video that is interactive, customisable by the user or generated by AI.

Interested in Interactive Video From Brands

Interested in Customisable Video From Brands

The Young & The Rich

Younger consumers and high-income earners are the early adopter demographics identified in our 2022 market study. They were even more interested in personalised and innovative video than the general public, especially when it comes to AI video. These demographics also continue to show a higher interest in personalisation and video.

Sharing This Report

You are welcome to share data from this market study on your website as long as you provide a link to Idomoo in a prominent place alongside the statistics and findings shared.

Methodology

Idomoo and Atomik Research conducted a study of 2,009 consumers in the U.S. and the U.K. in April 2023 focused on digital brand communications with customers. The margin of error is +/-2 percentage points with a confidence level of 95%.

Defining High Earners

For the purposes of this study, higher earners in the U.S. were considered those with an annual income over $150,000. In the U.K., high earners were considered those with an annual income over £75,000.